Strengthen Your Finances With Commercial…

When striving into the arena of commercial real estate in…

From first-time buyers to refinancing, we provide expert mortgage solutions tailored to you.

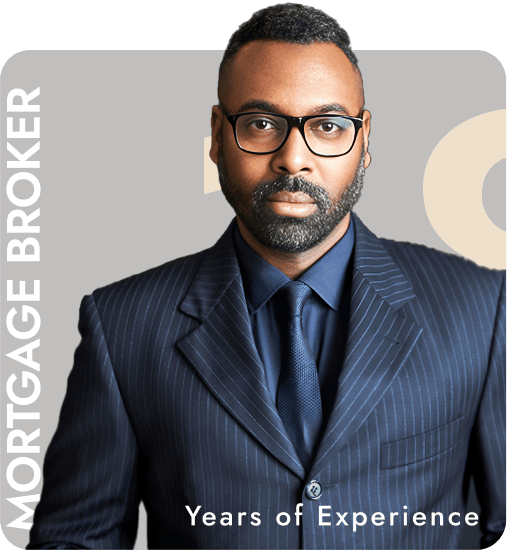

Mortgage Agent Level 1

Mark Robinson is a Toronto-based mortgage broker with a diverse background in technology, education, and the service industry. A former technology learning experience designer, he developed a knack for making complex information accessible—a skill he now uses to guide his clients through the mortgage process with clarity and confidence.

We specialize in offering private mortgage solutions designed to meet the needs of borrowers.

We specialize in offering private mortgage solutions designed to meet the needs of borrowers.

We specialize in offering private mortgage solutions designed to meet the needs of borrowers.

We specialize in offering private mortgage solutions designed to meet the needs of borrowers.

We specialize in offering private mortgage solutions designed to meet the needs of borrowers.

We specialize in offering private mortgage solutions designed to meet the needs of borrowers.

The rate of your mortgage remains fixed for the term, regardless of changes in the market.

Your monthly mortgage payments can go up or down based on the Bank of Canada’s prime interest rate

When striving into the arena of commercial real estate in…

In the dynamic world of real estate development, navigating the…

Thinking about buying a home in Canada? A Mortgage Stress…

— Frequently Asked Questions

Qualification depends on factors like credit score, income, debt-to-income ratio, and down payment.

You can apply through my email at mark.robinson@orbismortgage.ca , text or phone number at 416-301-5083

The process usually takes 7-10 days from application to approval, but this can vary based on individual circumstances.

Rates are influenced by market conditions, your credit score, loan term, and down payment amount.

Your payment typically includes principal, interest, property taxes, and homeowners insurance (often referred to as PITI).

Yes, only a % of mortgage amount can be payoff without penalty. Check your specific loan terms for details.

Yes, I offer in-person consultations at your convenience. Just send me a text, email or call me at 416-301-5083